The Regulatory Landscape of Buy-Now-Pay-Later (‘BNPL’) in Malaysia: Challenges and Opportunities

Keywords:

Buy Now Pay Later, Malaysia, regulatoryAbstract

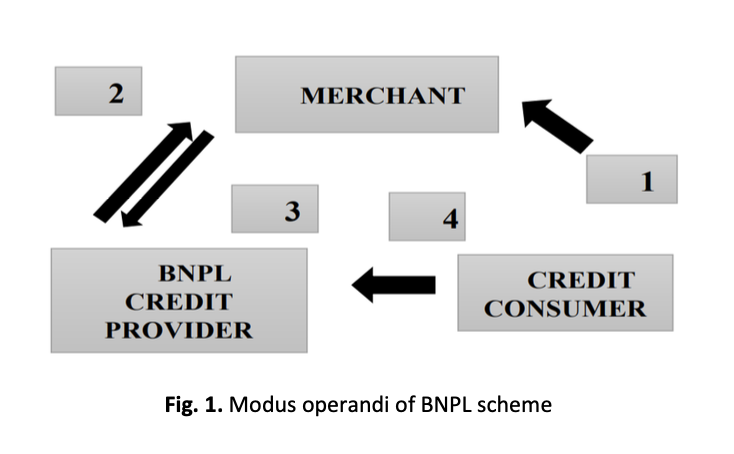

In Malaysia, the Buy-Now-Pay-Later (‘BNPL’) business model has rapidly taken off offering both merchants and customers more sales opportunities and flexible payment options. However, due to BNPL services expanding rapidly there are special regulatory issues that call for striking a careful balance between encouraging innovation and safeguarding the interests of customers. The fast development of BNPL in Malaysia has emphasised the persistent need for stricter regulations. The study has applied the qualitative legal research method via doctrinal analysis with the aim of conducting an in-depth analysis of the selected documents. Currently, there is no specific legislation to govern BNPL transactions in Malaysia. Thus, the Consumer Credit Bill 2025 is a significant step forward, but it requires coordinated efforts between Bank Negara Malaysia, the Consumer Credit Oversight Board and other pertinent agencies adequate regulatory resources for full compliance monitoring and enforcement and continuous consumer education and financial literacy programs to guarantee that the general public is fully aware of their rights and risks associated with BNPL schemes.